how to avoid paying nanny tax

The net is your nannys take-home pay so cut that check. Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live.

Tax Reminders Archives Page 2 Of 2 Nannypay

Ad Easy Nanny Tax Withholding Services At Your Convenience with Personalized Support.

. This number equals gross wages. No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Your nanny is on board as she gets a few extra dollars in her paycheck.

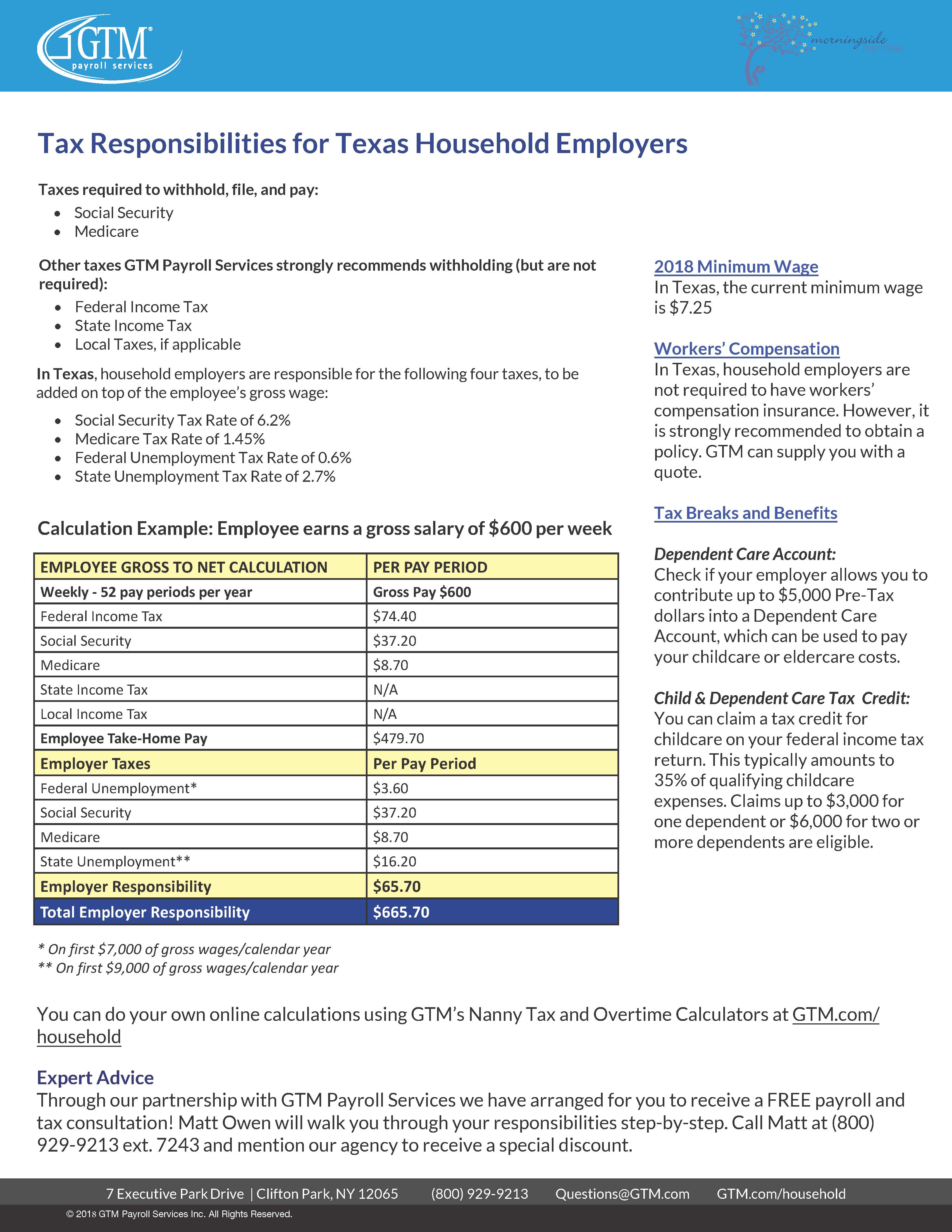

Check with your employer to see if they offer this cafeteria plan service. No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver.

How to File and Pay Nanny Taxes. FUTA tax is normally applied. Tered under the Federal Unemployment Tax Act FUTA when they pay their employees more than 1000 in any quarter of the current or preceding calendar years.

Youre not running for political office or being nominated for a position in government. Call Us For A Free Quote Today. Complete year-end tax forms.

Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. If they hire a nanny they may be considered household employers and could be responsible for paying and withholding nanny taxes such as Social Security Medicare and. How can I avoid paying nanny taxes.

Everything You Need to Know about Paying Nanny Taxes. The nanny tax threshold of 2000 for 2017 is increasing to 2100 in 2018. What is the nanny tax.

Ad No Money To Pay IRS Back Tax. What you deducted from your nannys pay is what you need to send to the IRS and your states. Easy Tax Preparation Management.

Pay your every other week maids no more than 5765 per home cleaning. Its time-consuming and may seem overwhelming. The goal here is to avoid doing something stupid that will trigger an IRS audit ignite tabloid headlines or.

Pay your weekly maid no more than 2883 per house cleaning. You should send 1040 estimated payments to the IRS four times per year. If an employer initially makes.

And those are only. If you or your spouse has access to a dependent care flexible spending account through work you can pay for up to 5000 of care-related costs pre-tax. The savings can add up to thousands of.

The IRS estimates that it can take a. For example 40 hours times 15 equals 600. Calculate social security and Medicare taxes.

Multiply the number of hours by the hourly wage. Although you may not think of yourself as an employer if a household worker such as a maid or gardener works for. You must provide your nanny with a Form W-2 by the end of January each year so they.

With this option you can reduce or fully offset your nanny tax fees. For you the employer you will have peace of mind knowing you will avoid IRS and state audits and you could be eligible for tax breaks to offset the cost of the nanny taxes. Youll need an employer identification number EIN if youre responsible for paying a nanny tax but this doesnt have to be a challenge.

Nanny Household Employment Tax Who Owes It Taxact

2018 Nanny Tax Responsibilities

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

How To Avoid The Nanny Tax Maid Service Faqs

What Is The Nanny Tax And Am I Required To Pay It

How To Pay Nanny Taxes Yourself Care Com Homepay

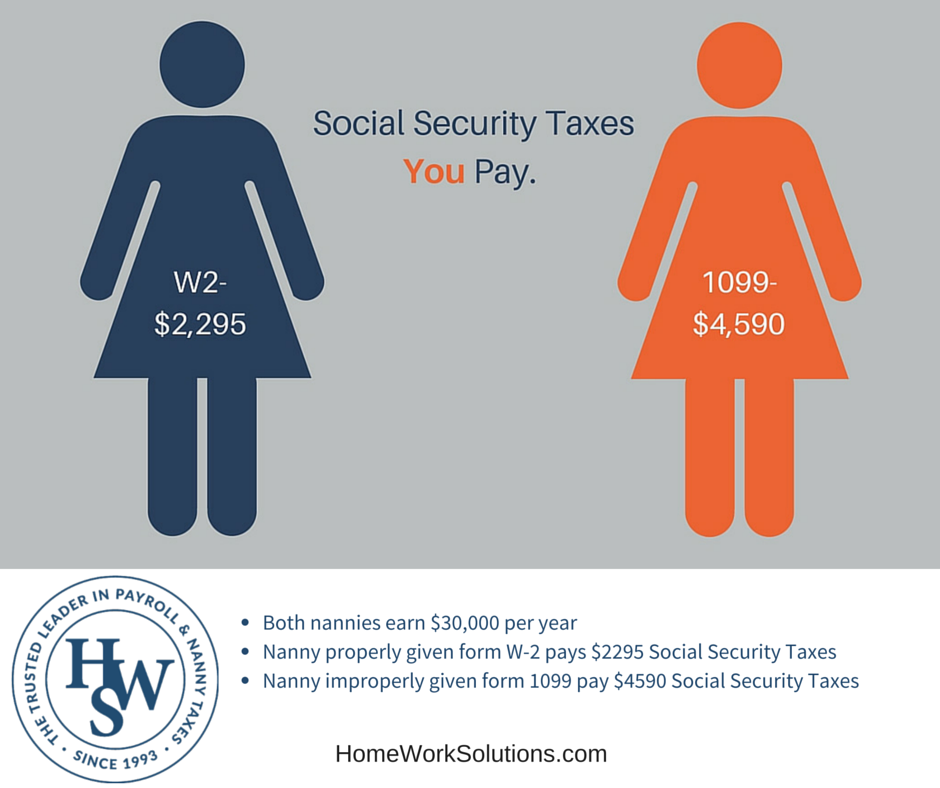

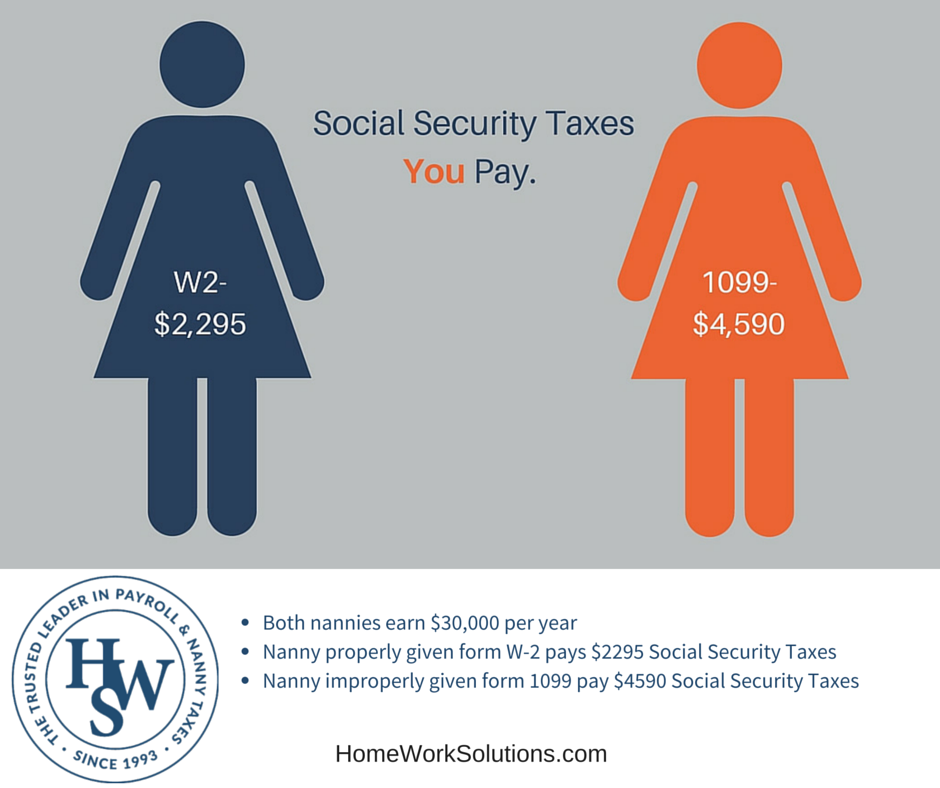

Nanny Given A 1099 Fights Back

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

The Differences Between A Nanny And A Babysitter

3 Ways To Pay Nanny Taxes Wikihow

6 Household Employment Mistakes And How To Avoid Them Care Com Homepay

How To Keep Your Nanny Tax Clients Happy Cpa Practice Advisor

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

How Do Nanny Taxes Work Date Night Boutique

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)